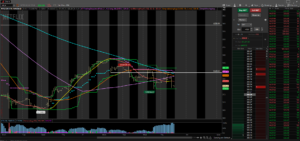

Netflix is one of the most beloved stocks for investors. Rarely do I ever hear about NFLX being mentioned by my clients as being overvalued. Traders and investors tend to only want to buy the stock. Yet, my charts have told me a different story. I am bearish on NFLX. My clients already know this since they received my short signal on NFLX. So far, it has worked out for us. This was a great opportunity and a solid way to hedge my other tech plays. While I am not a permabull, I rarely have tried to short stocks this year. Especially a stock like NFLX which again is highly desired for buys only. Historically, I have had great success shorting in a bull market. It will always be about the opportunity and the signs of weakness we teach in our room to look out for. While I do not think NFLX will be a home run, we are already in a great position for success. IF the markets continue lower thanks to the POTUS piling on more tariffs to China, NFLX could turn out to be a huge winner. Keep an eye out for the NFLX weakness to continue.

Follow me on Twitter: @DiscipleOfTrend