The POC (Point Of Control) and VWAP (Volume Weighted Average Price) are two technical indicators used by traders. Many traders use the terms interchangeably, but is it correct to do so? No, it is not correct to equate the two indicators.

Both represent where the most trading occurred.

The VWAP relates to volume. It is the PRICE at which the most VOLUME traded for a specified timeframe.

The thicker purple line represents the VWAP in the chart above.

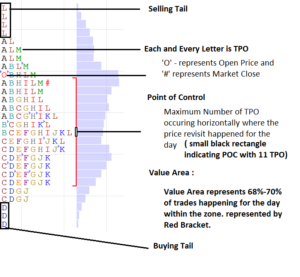

The POC relates to time. It is the PRICE at which trading spent the most TIME at.

Very often people confuse time with volume and think that the price the market traded at the longest would have the most volume, but this is a misconception. Especially when looking at 24-hour charts, the POC does not necessarily mean the highest volume price. If only viewing the day session, many times the POC and VPOC are very close or the same, but not always.

For day trading in our Short-Term Options Room, we use the VWAP.