Many traders are familiar with the concept of the covered call strategy. Few know what it really means though.

The concept is quite simple. You own stock. You then sell a call with a strike price above where the stock is currently trading.

What you have essentially done is taken a long equity position and created a “synthetic put” position from that. The formula is quite simple:

Call + Strike = Put + Stock Price

Here are the three graphs.

Long underlying stock:

Short call:

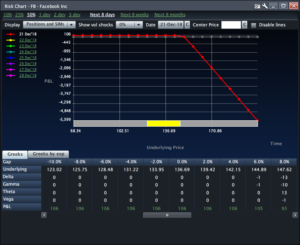

The combination of the two looks exactly like a long put:

This strategy achieves a couple of things. You give yourself a bit of downside protection. Specifically, the premium you collect lowers the cost basis you paid to get into the stock. If I buy 100 shares of Facebook at $137 and I sell a December 150 call for $1.00, I am effectively long FB for $136.

If FB rallies to $150 at expiration, that is great! I am still long the underlying from $136 and my calls that I sold are still worthless! I make $14 in my underlying stock position and the options go out at zero!

If FB goes down in price, then at least I have mitigated a portion of my loss.

If FB rallies hard, well then I left money on the table.

Let’s say FB rallies to $170 by expiration. My underlying position is doing just fine. I am long from $136 and it’s trading $170. A gain of $24! But whoever bought the 150 calls from me is going to exercise their right to get long FB at $150. I have capped out my gain. I will then deliver to them the stock I already own.

Still a good story overall, but hindsight is always 20/20.

Happy Thanksgiving to all!