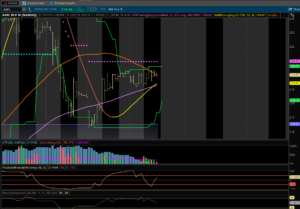

I normally do not ‘give’ away any signals, but I have spoken about $AAPL recently. I think it is time for a nice breakout move. While the markets are in a bit of a standstill, we could see a strong bump in the markets after the FOMC meeting. If that is the case, you would have to expect $AAPL to move in sympathy. In fact, I expect $AAPL to be a leader if we move higher. What I am going to show you is a chart of $AAPL on an hourly time frame. What you are going to notice is how sideways the stock has gotten. While there is some resistance above, I honestly feel that there are more growth capabilities for $AAPL than $AMZN. That being said, this is NOTa buy if the markets move lower and unravel (Unless Apple bucks that trend of course). What I am looking for is $AAPL stock price to crossover the top of the channel or the upper green line. Once it CLOSES above the upper green line, we must OPEN above as well. If the stock holds or rejects at the upper channel, we have signs of a potential breakout. The markets want it. Traders want it. I WANT IT. Your eyes must be on $AAPL near term at the $220.59 price. That is the upper channel and the price of interest. Go FOMC and Go $APPL breakout.