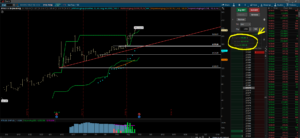

BYND at current price levels is flat out nuts. It is clear they are way beyond any sensible valuation, and now it is just purely a momentum play. Not a care about future guidance or P/E ratio, this is about short term opportunity. It is a perfect storm surrounding this name. A crazy amount of demand from the streets, and a limited supply available. This also means a limited supply for sellers to try and short the stock. Even with put option demand at an insane premium, This stock can only go up it seems. At least regarding recent trading sessions. At this point if you are not in, then stay away. The risk is substantial considering the price level and volatility. If you want to play, make sure you are only considering short term plays. You must be disciplined to exit when you should, and do not think this stock can only go up. People thought the same in TLRY. Yet, TLRY dropped from $300 to current levels ($47 range) and it happened quickly. Now BYND and the current rally has been much more controlled than the run in TLRY, but the demand and history is proving to be similar. In no way am I suggesting $BYND will go to $300. Technically it can go much higher, but at some point we should see a slowdown….maybe. For now, enjoy the ride/show.

Follow me on Twitter: @DiscipleOfTrend