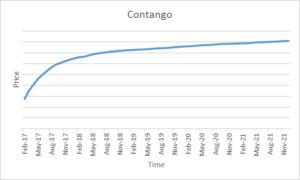

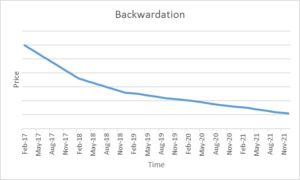

Contango and backwardation are terms used to define the structure of the a time structure curve. For example, the yield curve, the VIX curve or a commodity such as Gold or even Corn. When a market is in contango, the forward price of a futures contract is higher than the spot price. Conversely, when a market is in backwardation, the forward price of the futures contract is lower than the spot price.

Follow me on Twitter @MikeShorrCbot