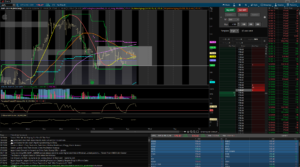

Yes… everyone wants to buy AAPL. Everyone will scream to buy AAPL. So here is my case to buy AAPL. Not because I like the company, but because of the setup I currently have. As you can see, AAPL has gone sideways on the hourly chart. Consolidation periods are generally a sign of a breakout to come. Some expect the breakout to be like how EA has traded lately and how GRUB had moved on the news of Postmates pursuing an IPO. That is not always the case and it is hard to see the news coming. As retail traders, this is how you want to see consolidation. From there, we can potentially find big movers once the stock escapes the consolidation range. Keep your eyes on AAPL this week.