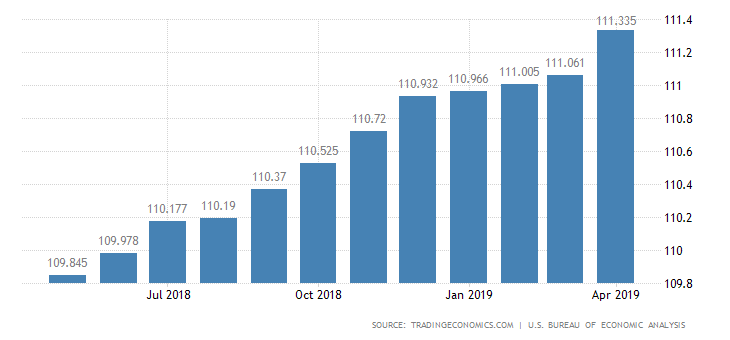

The Fed is again at the forefront of investor’s attention. After a decade of trying to right the ship, through various programs, we find ourselves again at an economic crossroads. Do they continue with their dovish stance on monetary policy, simply stay the course or even ramp things up by cutting rates? In order to determine this, it’s important to ascertain what key metrics the Fed looks at. After all, they have stated that they will be data-driven in their decisions. One very important, yet underreported, piece of data is the

personal consumption expenditure deflator or PCE.

The personal consumption expenditure deflator index measures the prices paid by consumers for goods and services. It is one of two followed measures of consumer prices. Because the consumer price index and the PCE index are based on different underlying concepts, they are constructed differently and tend to behave differently over time. The CPI garners more attention from the public; the Fed’s preferred measure of inflation is the PCE deflator. The “core” PCE price index is defined as personal consumption expenditure (PCE) prices excluding food and energy. The core PCE price index measures the prices paid by consumers for goods and services without the volatility caused by movements in food and energy prices to reveal underlying inflation trends. Food prices consist of those included in the PCE category of “food and beverages purchased for off-premises consumption.” Prices included in the PCE category “food services and accommodations” are not included in the “food” price index because these services prices tend to be far less volatile than those for food commodities such as meats, fresh vegetables, and fruits. Energy prices consist of those included in the PCE categories of “gasoline and other energy goods” and of “electricity and gas” utilities.

The metric has its strengths and weaknesses like anything else:

Strengths

- Of all the measures of consumer price inflation, the PCE deflator covers the broadest set of goods and services.

- The weights change based on shifts in consumer spending while the weights for the CPI are fixed for two years.

- the PCE index measures the change in goods and services consumed by all households, and nonprofit institutions serving households.

Weaknesses

- Released after the CPI.

- Medical care services have a large weight on the PCE. Therefore, deviations in medical care costs can cause the PCE to differ noticeably from the CPI.

Follow me on Twitter @MikeShorrCBOT