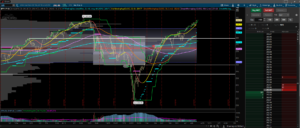

The SPY has been trucking along in 2019 and here we are in late April about to make new all-time highs. This is no small feat ladies and gentlemen. New all-time, never before seen in the history of trading highs. This also applies to the QQQ and DIA also. Yes, all three major markets trying to make new all-time highs. The biggest issue is that a lot of retail traders were on the sideline. Crippled with the fear of the “washout”, a lot of traders have been contrarian and playing the DOWNSIDE in the markets. All because they believed we were due for a washout similar to what we had in the latter half of last year. Sorry but that happens far less than the markets rallying to new highs. That has been consistent in the last decade. This is where as a trader you have to be more opportunistic versus fearful. Yes, the losses sustained last year stung and still stings, but this is a new calendar year and the markets are behaving totally different. The only thing that is stopping the trader is the trader themselves. We are in a strong bull market. Stop thinking otherwise. The chart has been telling you everything these days.