Introduction: Exploring Meta’s Role in the Stock Market

Hey everyone – I’m Scott Bauer, and today we’re zooming into Meta’s current standing in the stock market. As part of the esteemed ‘Magnificent Seven’ tech stocks, which also include heavyweights like Netflix, Amazon, Alphabet, Microsoft, Apple, and Nvidia, Meta has been a significant market influencer. This year, these stocks have led the market’s movements, particularly noticeable after the rally we saw in November. However, Meta has experienced a recent pullback, which is particularly intriguing. This shift demands a detailed analysis to understand what it means for investors, especially considering the broader market trends and the potential implications for Meta’s future performance.

Meta’s Stock Analysis: Understanding the Technicals

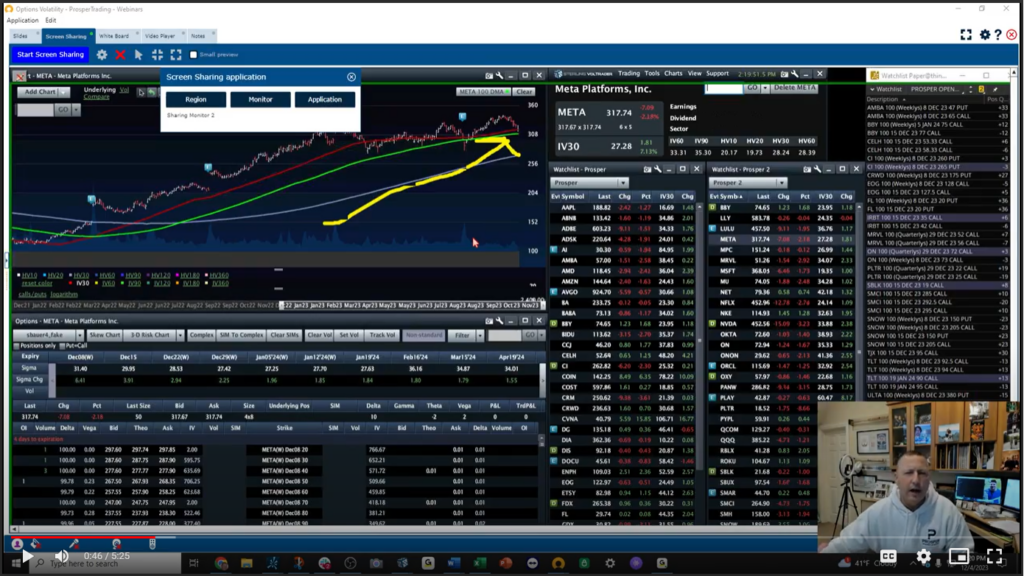

Meta’s stock has experienced a pullback, bringing us to two key technical levels that are vital for understanding the stock’s behavior:

- The 50-Day Moving Average (Red Line): This line has been a consistent support level for Meta, often indicating where the stock finds stability and possibly rebounds.

- The 100-Day Moving Average (Green Line): Alongside the 200-day moving average (blue line), this line serves as a long-term trend indicator and support level.

The importance of these moving averages cannot be overstated. They provide investors and traders with critical insights into market sentiment and potential future movements of Meta’s stock. This historical perspective, especially over the past 18 months, can be a valuable tool in predicting future trends and making informed investment decisions.

Implied Volatility and Options: A Market Indicator Analysis

In the current Meta stock scenario, two significant factors stand out:

- Implied Volatility: The low level of implied volatility, despite the stock’s decline, is an unusual yet important signal. It often indicates a divergence between market expectations and actual stock performance, suggesting that there may be unexplored opportunities for investors.

- Option Premiums: The unusually low option premiums, the lowest in the last two years, provide a potentially lucrative entry point for savvy traders. This could signal a period of undervaluation, offering a window for strategic investments in options.

These indicators are crucial for understanding the broader market dynamics at play. They can help traders and investors identify unique opportunities that might not be apparent through traditional analysis methods.

Scott’s Strategic Recommendation: The Broken Wing Butterfly

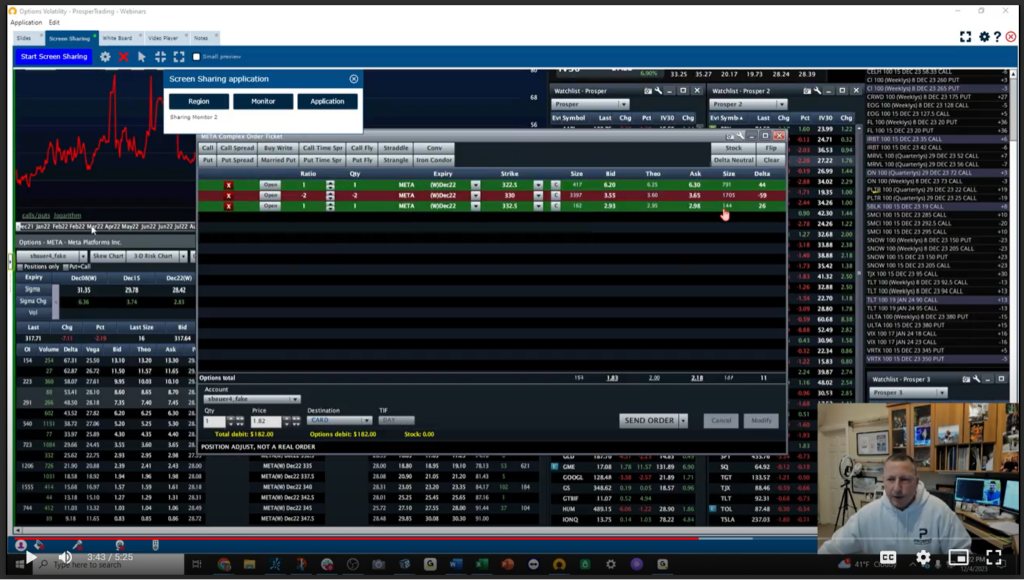

In light of Meta’s current market position, I recommend looking at the ‘broken wing butterfly’ spread strategy in call options. This strategy is particularly suited to the present market conditions characterized by low implied volatility and robust support levels:

- Understanding the Strategy: This strategy involves a unique setup of call options, where you buy and sell options at different strike prices, creating an asymmetrical structure that favors upward price movements.

- Advantages of This Strategy:

- It is particularly effective in periods of low volatility, allowing traders to capitalize on small price movements.

- Aligning with Meta’s current support levels, it provides a strategic edge, increasing the likelihood of a successful trade.

Executing the Strategy: A Step-by-Step Guide

Implementing the ‘broken wing butterfly’ strategy involves a few critical steps:

- Adopting a Bullish Stance: Given Meta’s strong historical support levels and the current market dynamics, a bullish position could be advantageous.

- Setting the Target Range: With Meta trading around $317.5, aiming for a target price range of $332.5 to $335 in the next three weeks could be a viable strategy.

- Managing the Spread: This involves buying a call spread that is $75 wide and selling a spread that is $25 wide. This asymmetry is what gives the strategy its name and its unique advantage, allowing for greater flexibility and potential upside.

Conclusion: Capitalizing on Meta’s Market Position

To conclude, Meta’s current position in the market, characterized by significant support levels and low option premiums, presents a unique opportunity. The ‘broken wing butterfly’ spread strategy is an innovative way to leverage these conditions. It’s important for investors and traders to remain vigilant and responsive to market changes, as these conditions can evolve rapidly. Staying informed and adaptable is key to capitalizing on these opportunities.