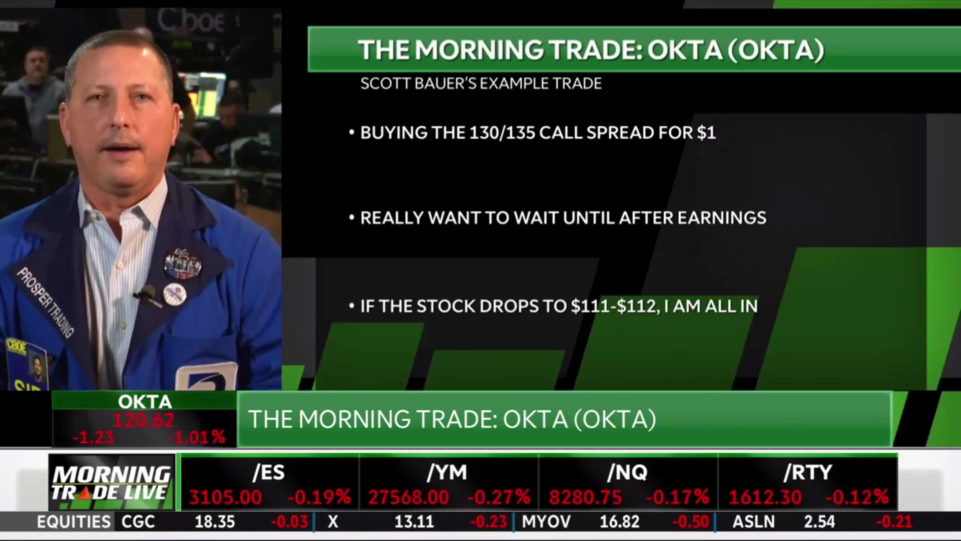

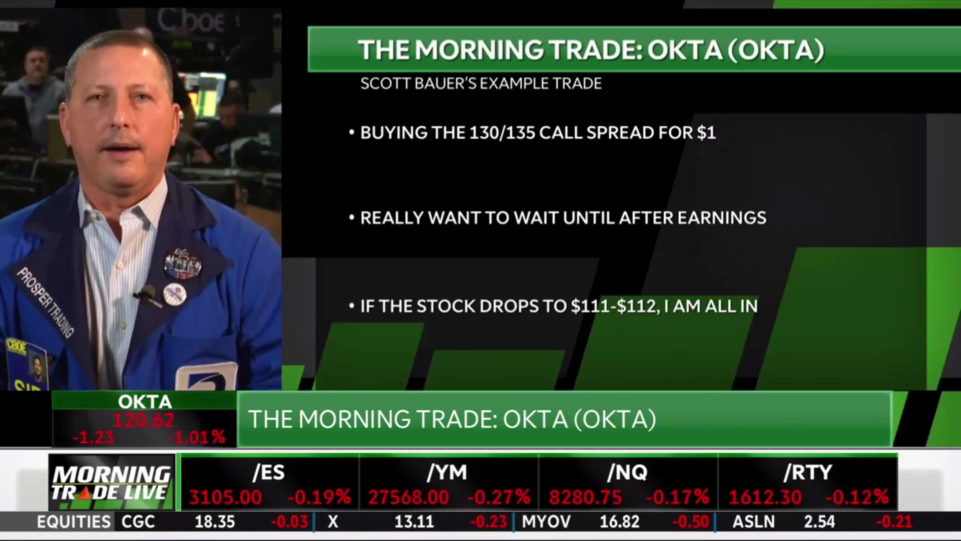

This morning, Scott Bauer joined Oliver Renick on TD Ameritrade Network’s Morning Trade Live to discuss an example trade on $OKTA and more. Grab a free five day pass to Scott’s live signal trading room today: http://bit.ly/nl-freepass

This morning, Scott Bauer joined Oliver Renick on TD Ameritrade Network’s Morning Trade Live to discuss an example trade on $OKTA and more. Grab a free five day pass to Scott’s live signal trading room today: http://bit.ly/nl-freepass

In this article, we’ll dive into the 12 best prop trading firms we observe on the market right now. Many prop trading firms often offer a variety of unique perks and opportunities to prove your trading capabilities in a variety of markets. There are a lot of proprietary trading firms out there, and it’s often […]

Read ArticleThe trading space is about to experience a significant paradigm shift that reportedly promises to enhance market efficiency and liquidity. On Tuesday, May 28th, the United States, Canada, and Mexico all transitioned from the T+2 to T+1 settlement cycle. This change is poised to reshape trading by significantly expediting the time between executing a trade […]

Read ArticleOn May 22, chipmaker company Nvidia Corp (NVDA) announced a massive 10-for-1 stock split, sending shockwaves through the trading space. The split went into effect after market hours on June 7, which is expected to have drastic implications on how Nvidia is perceived and traded. The news is causing traders to ask a lot of […]

Read ArticleUnderstanding the Delta of an option is crucial for both new and seasoned traders. It’s one of five specific calculations called “Greeks,” which help measure specific factors that could influence the price of an options contract. Delta is a metric that helps you gauge how much the value of an option contract is expected to […]

Read ArticleRho is the rate at which the price of a derivative changes relative to a change in the risk-free rate of interest. Rho measures the sensitivity of an option or options portfolio to a change in interest rate. Rho may also refer to the aggregated risk exposure to interest rate changes that exist for a book of several options positions. For example, […]

Read ArticleThere are a number of different types of options expiration types. In the vast majority of our signals, our options will be categorized as “American”-style options. There are some, like VIX options, that are “European”-style options. Here’s a quick explanation of both. The term “American style” in relation to options has nothing to do with […]

Read ArticleWe choose to let our members and students speak for themselves. We do not actively solicit testimonials, no compensation has been paid for any testimonial, and testimonials are not necessarily representative of the experience of all students. All monetary claims made in testimonials that you see depicted in our marketing material have been verified by Prosper Trading Academy and attested to by the members that have given them. Verified testimonials encompass “experience” reviews that highlight the personal experiences of working with our team and “performance” testimonials where we verify trading success of students who have enrolled in our programs.Given the broad reach of the internet, testimonials and reviews of our programs that we have not been able to verify can be found on various websites across the internet which are beyond our editorial control. While we do very much enjoy hearing positive things from our students and it is critical to our mission that everyone is satisfied with their journey with Prosper, we encourage you to take both verified and unverified testimonials for what they are.