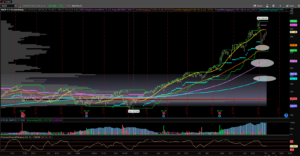

Shopify Inc. (Ticker:SHOP) is one of the best names to park money in for 2019. Plain and simple, EVERY SINGLE DIP IS BOUGHT UP. Up nearly 200 points for 2019 (yes you read that right), this is stuff dreams are made of. I continue to watch in amazement and of course for any dip to grab. Sometimes the stock is not allowed to drop more than 5% off the highs until recently that is. SHOP had a hard drop in recent days, but once again the stock is back doing what it does best. Rally! Sure enough, since the recent swing low, SHOP has had 5 days for ‘Higher highs and higher lows’. I do not see this slowing down, although there are some signs things may be coming to that point. The recent drop was by far the biggest of the year, both points and percentage-wise. I think SHOP will continue higher, but even a rally to the highs is just fine. Keep SHOP on your radar, and strongly consider this name moving forward. As long as the uptrend sustains, SHOP will continue to be a big gainer.

Follow me on Twitter: @DiscipleOfTrend