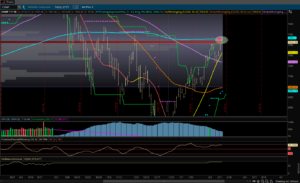

We have faced a wee bit of market weakness as of late so let’s take a look at where we are in the Nasdaq. I see two levels of importance in the very near term. The 7,500 level for support and the 200-day SMA as support. If either or both levels hold the stock market should be up in the near-term Expect a strong reaction to the upside. I think it will be very important in the near term that a floor is established. With political news and media now mentioning the trade deal rally is already priced into the markets, we are starting to see a little risk-off trading. Buyers taking some profits and not looking to buy back in basically. The instant slam in the tech names the other day gave me a little warning of what is to come. However, I still think there is way more upside and I don’t believe the markets have “baked in” the trade deal completely. In fact, if the FOMC continues to not push for higher rates and this deal does come through, I fully expect the markets to rally and rally strong. Let’s watch and see if the Nasdaq bounces in the near future.