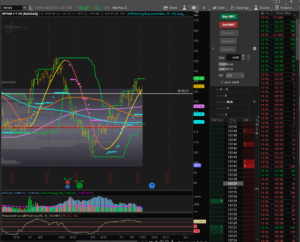

WYNN has been a name I have spoken about and written about. I think it is time to strongly consider the upside. In fact, we have called an aggressive entry in WYNN today. While I am not expecting huge gains, I am expecting decent returns in a short period of time. We also have a time constraint due to earnings out in early August. That being said, there has been a high level of demand over the last couple of months. As the markets continue to be ‘Risk on” leading into the FOMC meeting at the end of the month, WYNN is a name that both looks good and offers good value in the longer term. Of course there is a reason why WYNN struggled for gains and felt the pressure from sellers in 2019, I think the timing is right to play the upside. We will know in the very near term if we timed our opportunity correctly, but I like the opportunity today. Keep an eye on WYNN and stay tuned for an update.

Follow me on Twitter: @DiscipleOfTrend