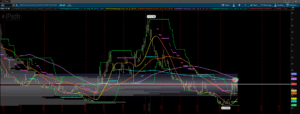

What a hot mess the markets have been. Back to being risk-on from a simple note by the White House. They will delay the tariff on automobiles. Once the news hit the wire, markets went into rally mode. We are not up big by any means, but we sure are not moving down today. The recent back and forth trading is causing the VIX products to swing all over the place. There has been technical weakness in the VXX, which is an ETN that tracks the VIX futures contract. I alerted the room to the VXX 200 day SMA level an important indicator to watch closely in the near term. I felt if the VXX closed above that level, it would spell potential trouble for buyers. Big time trouble. Alas, markets are back to being “normal” and the risk-on trade is broad now. Not saying we can continue higher here, but I would not be surprised to see the markets wipe out and then some this week.

Follow me on Twitter: @DiscipleOfTrend