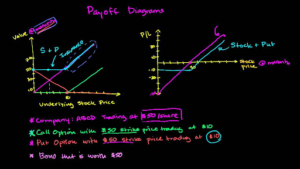

Put-call parity is a principle that defines the relationship between the price of European put options and European call options of the same class, that is, with the same underlying asset, strike price, and expiration date. Put-call parity states that simultaneously holding a short put and long call of the same class will deliver the same return as holding one contract on the same underlying asset, with the same expiration, and a forward price equal to the option’s strike price. If the prices of the put and call options diverge so that this relationship does not hold, an arbitrage opportunity exists, meaning that sophisticated traders can theoretically earn a risk-free profit. Such opportunities are uncommon and short-lived in liquid markets.

The equation expressing put-call parity is:

C + Strike = P + Stock Price

where:

C = price of the call option

Strike Price = the present value of the strike price (x), discounted from the value on the expiration date at the risk-free rate

P = price of the put

S = The current market value of the underlying asset