Gold has been a confusing trade over the past few weeks, to say the least. Why would gold rally the way that has when the stock market is continuing to surge? The most direct reason is that this is a currency play. We have written a number of times outlining why this is the case. But one factor has been left out. China.

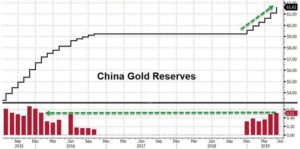

China continued its renewed (public) gold-buying spree in May adding almost 16 tons of the precious metal to its reserve – the biggest monthly increase since January 2016.

“It’s a diversification away from the U.S. dollar, particularly given the trade tensions and the potential technology cold war that’s evolving,” said Bart Melek, global head of commodity strategy at TD Securities.

“We have to remember that gold is nobody’s liability.”

Follow me on Twitter: @MikeShorrCBOT