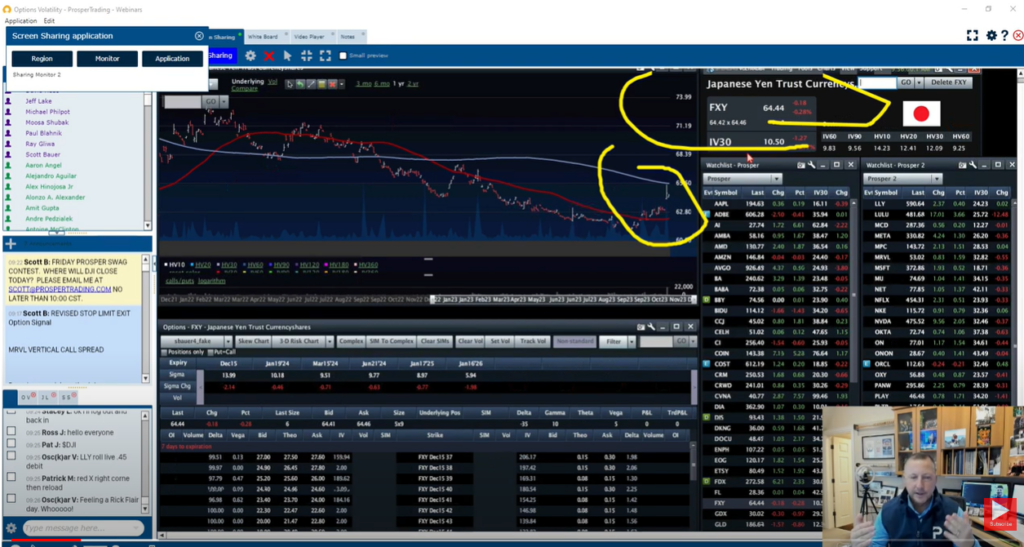

As a trader, I am always on the lookout for opportunities in the market, and lately, the Japanese Yen ETF (FXY) has caught my attention. The Yen has been particularly volatile recently, with a massive spike up yesterday that brought it right up to the 200-day moving average. This move was caused by growing anticipation of a policy shift by the Bank of Japan, which has kept rates at basically zero forever to try and stimulate the economy. With their next central bank meeting coming up on December 19th, there may be a potential opportunity to capitalize on this volatility.

Analyzing market opportunities, I have been looking at a type of trade called a Texas Hedge, which involves doubling up on the same side of a position. In this instance, I am considering a short position on the call side and a long position on the put side of FXY. By selling a call spread and buying a put spread or buying puts outright, I can potentially profit if FXY doesn’t move or goes down slightly, while having protection if it reverts back and bounces down off of the major resistance area at the 200-day moving average.

Overview of FXY and Recent Volatility

What is the FXY ETF?

FXY is an exchange-traded fund that tracks the performance of the Japanese yen against the US dollar. As with all currency ETFs, FXY is subject to fluctuations in the foreign exchange market, which can be affected by a variety of factors such as changes in interest rates, economic data releases, and geopolitical events.

Recent Spike in the Yen

Recently, there was a significant spike in the value of the yen, causing a corresponding increase in the value of FXY. The spike was attributed to speculation that the Bank of Japan may shift its negative interest rate policy, which has been in place for a long time. This speculation has caused growing anticipation of a policy shift, leading to a surge in demand for yen.

The spike in the yen has resulted in increased volatility in the FXY ETF, which has been reflected in the options market. The call skew has increased significantly, meaning that the implied volatility on call options is far greater than the implied volatility on put options. This has created an opportunity for traders to sell calls and buy puts to take advantage of the increased volatility.

Looking at the January options, there is a significant skew towards call options, with a 30 to 1 call to put ratio. This high demand for call options has resulted in significantly higher implied volatility on calls compared to puts.

To take advantage of this opportunity, I am considering a Texas hedge strategy, which involves doubling up on a short position on the call side and a long position on the put side. This will allow me to profit from a decrease in the value of FXY while limiting my risk to the upside. Specifically, I am looking to sell a 65-66 call spread and buy a 63 put to create an ultra-short position on FXY. This strategy will allow me to benefit from the current market conditions while limiting my downside risk.

Factors Influencing the Yen Movement

Upcoming Bank of Japan Meeting

As of the current date, the Bank of Japan is scheduled to hold its next central bank meeting on December 19th. There are rumors and speculation that the bank may shift its negative interest rate policy, which has been in place for a long time. The bank has kept rates basically zero to stimulate the economy, but the Japanese yen is weak compared to the dollar, and there is growing anticipation of a policy shift by the Bank of Japan. If the bank raises rates, it could cause a big appreciation in the yen, as seen in the massive spike up in the yen ETF (FXY).

Speculation on Interest Rate Policy Shift

The speculation on the interest rate policy shift by the Bank of Japan has caused volatility in the yen. The implied volatility on call options is far greater than the implied volatility on put options, which creates a skew in volatility. The call skew has increased significantly, as seen in the CME’s Cal CV chart, and the implied volatility on call options is much more expensive than the implied volatility on put options. This translates to the FXY ETF as well, where the January call options are much more expensive than the January put options.

Trading Opportunity

The Texas hedge is a potential trading opportunity for traders who want to take advantage of the current market conditions. The Texas hedge is a double position, where the same side is doubled up, which means short on the call side and long on the put side, or vice versa. Traders can potentially sell a call spread and buy a put spread or buy puts outright to create an ultra-short position in the Japanese yen. This strategy can be used to take advantage of the current market conditions and potential opportunities in the yen market. However, traders should be aware of the risks involved in this strategy, especially the risk to the upside if the yen goes up and the short call spread expands out.

Analyzing Market Opportunities

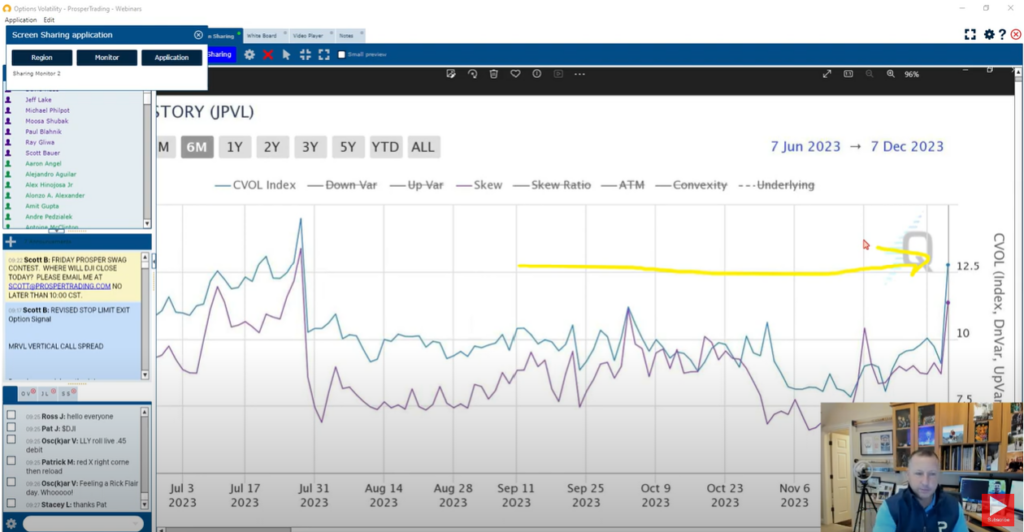

Volatility and Skew Charts from CME

Looking at the recent spike in the Japanese Yen ETF (FXY), we can see that there is a lot of volatility in the currency due to the news of the upcoming Central Bank Meeting on December 19th. As a trader, I like to look for opportunities in such volatile markets. One way to do this is by analyzing the volatility and skew charts from CME.

The CME’s Cal CV chart shows the volatility index and skew in volatility across various asset classes. The purple line on the chart represents the skew, which measures the difference in implied volatility between calls and puts. Yesterday, the skew in the Yen call options increased significantly, indicating that the implied volatility on call options is far greater than that of put options.

Interpreting Call Skew Increase

The recent increase in call skew presents an opportunity for traders to sell calls and buy puts to take advantage of the price difference. Looking at the January options for FXY, we can see that the implied volatility on call options is much higher than that of put options. The call skew is around 20-25% higher than the put skew, indicating a significant difference.

Moreover, yesterday’s trading volume in FXY was heavily skewed towards call options, with a 30 to 1 call to put ratio. This suggests a high demand for call options, which is driving up their prices.

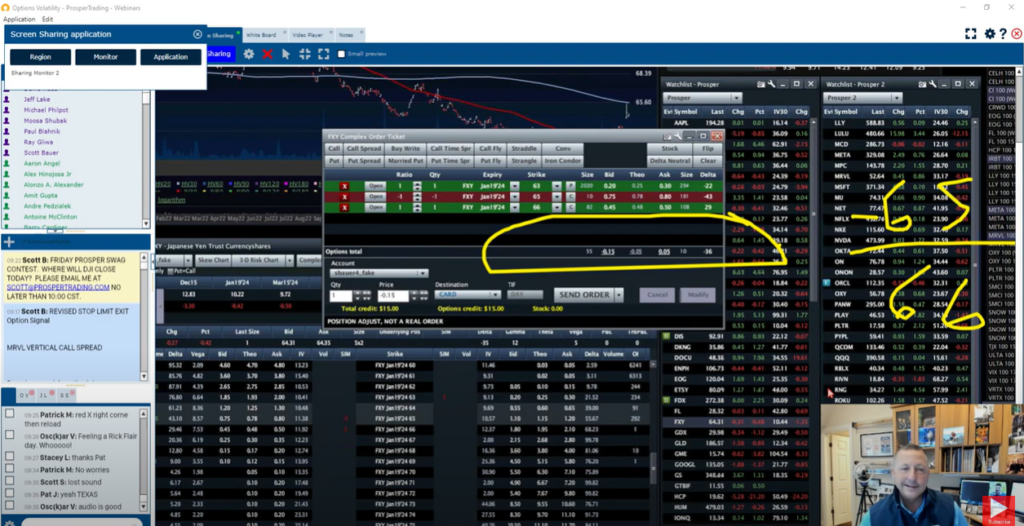

To take advantage of this opportunity, I am considering a Texas hedge position, which involves doubling up on the same side of the trade. In this case, I would take an ultra-short position on FXY by selling a call spread (65-66) and buying a put spread (63). This position would have limited risk to the downside, with the potential for a small credit, and significant upside potential if FXY were to revert back to its resistance level at the 200-day moving average.

In conclusion, by analyzing the volatility and skew charts from CME and interpreting the increase in call skew, traders can identify potential opportunities in the Yen market and take advantage of them using various trading strategies.

Trading Strategies for FXY

Option Trading Based on Implied Volatility

Looking at the charts from the CME, we can see that the implied volatility on call options is much greater than the implied volatility on put options. This means there is an opportunity to potentially sell the calls and buy the puts, or even buy Yen Futures to lock in the difference.

The January options are the ones to focus on, as the Bank of Japan meeting is on December 19th and the December options will have already expired. Currently, FXY is trading at around 645, and the out of the money call options have a higher implied volatility than the out of the money put options.

It’s important to note that there was a significant increase in call volume yesterday, with almost a 30 to 1 call to put ratio. This is likely due to the anticipation of a policy shift by the Bank of Japan, which could cause the Yen to appreciate even more.

Example of a Texas Hedge Strategy

One potential strategy to take advantage of this situation is to use a Texas hedge. This involves having a double position on the same side, either short on the call side and long on the put side or vice versa.

In this instance, I am looking to have an ultra short position on the Japanese Yen and FXY. I may sell a call spread (such as the 65-66 call spread) and buy a put spread (such as the 63 puts), potentially for zero cost or even a credit.

The risk to this position is to the upside, if FXY goes up and the short call spread expands. However, the potential reward is if FXY goes down, potentially bouncing off of the major resistance area at the 200 day moving average. In this case, the free puts to the downside would provide a profit.

Overall, using a Texas hedge strategy in combination with the high implied volatility on call options could potentially lead to a profitable trade in FXY.

Risk and Reward Analysis

Assessing the Potential Risks

As a trader, I always consider the potential risks before entering a trade. In the case of the FXY Japanese Yen ETF, there are a few risks to keep in mind. Firstly, the Bank of Japan is set to have its next central bank meeting on December 19th, and there is speculation that they may shift their negative interest rate policy. This could cause volatility in the Yen and the FXY ETF. Secondly, there is always the risk of market volatility and unexpected news events that could impact the value of the Yen and the FXY ETF.

Exploring Possible Rewards

Despite the risks, there is also potential for rewards in trading the FXY ETF. The recent spike in the Yen and the increase in call skew on the FXY options present opportunities for traders. By selling call spreads and buying put spreads or puts outright, traders can create an ultra-short position that could potentially profit if the FXY ETF declines. This type of position is known as a Texas hedge, and it can be a useful strategy in volatile markets.

Looking at the January options for FXY, I can see that the implied volatility on call options is much higher than that of put options. This presents an opportunity to take advantage of the high call skew by selling call spreads and buying put spreads or puts outright. By doing so, I can potentially profit if the FXY ETF declines, while minimizing my risk if the ETF were to rise.

In conclusion, while there are risks involved in trading the FXY ETF, there are also potential rewards for those who are willing to take on the risk. By assessing the potential risks and exploring possible rewards, traders can make informed decisions about whether or not to enter a trade.