As a seasoned options trader with a rich background in the industry, including time as a VP at Goldman Sachs, I want to share with you the ins and outs of the iron condor options trading strategy. It may sound overwhelming at first, but once you break it down, it’s simply a combination of a call spread and a put spread. Iron condors are a powerful tool to find potential profits in the markets, and in this guide, I’ll guide you through understanding how to effectively sell iron condors.

Selling the strategy involves looking for ideal conditions—it works best when you expect a stock to trade within a certain range. This range-bound expectation makes it advantageous to sell both a call spread and a put spread. Additionally, timing is crucial; you’ll want to enter into these trades when options are expensive due to high implied volatility. This high premium environment is ripe for selling options, and I’ll show you how to pinpoint these opportunities and set up an iron condor with the right expiration date to balance reward and risk.

Key Takeaways

- An iron condor is best utilized when expecting a stock to remain within a specified price range.

- Selling an iron condor is ideally done when option prices are heightened by increased volatility.

- Optimal structuring of an iron condor balances strike selection and expiration timing for risk management.

Want To Learn More About How To Trade Options?

Grab a free copy of our Ultimate Options Trading For Beginners course by clicking here

Understanding the Iron Condor Strategy

An iron condor is essentially a combination of a call spread and a put spread. I’ve been trading for over three decades, and throughout my experience, I’ve found that selling iron condors rather than buying them positions you better to capture potential profits. But let’s break down the why and the how of it.

The iron condor strategy shines when you expect a stock to stay within a specific price range, which we refer to as being range-bound. To implement this, I sell a put spread below the current stock price and a call spread above it. The goal is simple: ensure the stock price doesn’t breach any of the strike prices I’ve set until the options expire.

Key considerations when selling iron condors:

- Optimal Conditions: It’s best to execute this strategy when the option’s implied volatility is high because this inflates the option prices, allowing me to collect more premium upon selling.

A Real-World Example

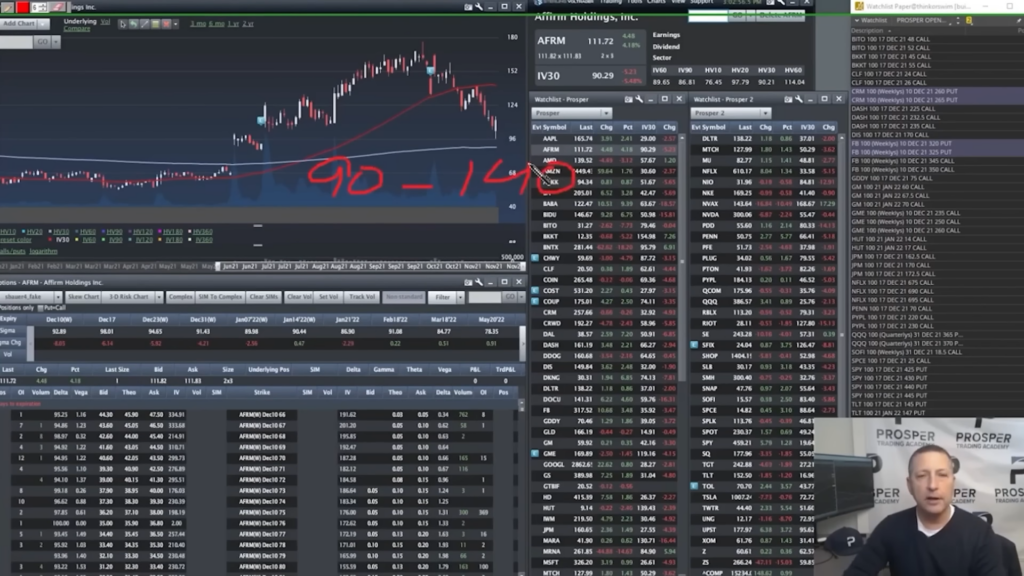

Let’s look at a specific scenario involving the stock ticker AFRM, which at the time sits comfortably between its 50-day and 200-day moving averages. With the stock trapped between these averages, I predict it will trade within this range for some time, which makes it a prime candidate for an iron condor.

Critical Price Levels:

- Upper Level: 50-day moving average at $140

- Lower Level: 200-day moving average at $90

With the stock’s current position, I’m inclined to set up a trade with no more than a two-week expiration. Extending the time increases the risk of price breaking out of the range.

Strike Selection Method:

- Using technical analysis, I assess which strike prices are ideal, ensuring they align with the expected price range.

Pricing the trade:

- Example: Put spread – $95/$90 and Call spread – $135/$140

- Combined Credit Sought: Approximately $1.20, which is lower than my target

My Selling Strategy:

- Premium Collected: I aim to collect around 50% of the width of the strikes on both sides.

- For $5 wide spreads, my goal is to collect roughly $2.50 in premium.

Risk and Maximum Value:

- The maximum possible loss on an iron condor is the width of either the put or call spread, not the span of both.

In summary, as a professional options trader, my take on iron condors is simple: they serve well in range-bound markets, and when crafted well, with expirations kept short and during high volatility, they can be an effective tool to add to your trading arsenal.

Components of an Iron Condor

Call Spread

When discussing a call spread, I’m generally referring to selling a call spread as part of an iron condor strategy. For example, if I take a position where I think a stock won’t move much above its current level, I’d sell a call option at a lower strike price and buy a call option at a higher strike price to cap my maximum loss. The ideal scenario is for the stock to stay below the lower strike price of the calls, which would allow me to keep the entire premium collected.

AFRM 135/140 Call Spread Example:

- Sell Call: Strike Price at 135

- Buy Call: Strike Price at 140

- Desired Outcome: Stock remains below 135 at expiration

Put Spread

On the flip side, when I sell a put spread, I’m looking at a situation where I’d sell a put option with a higher strike price while buying a put with a lower strike price, aiming to pocket the premium if the stock doesn’t dip below my sold put’s strike. The goal here is precise: for the stock to remain above the higher strike price at expiration, ensuring that I collect the premiums without any further obligation.

AFRM 95/90 Put Spread Example:

- Sell Put: Strike Price at 95

- Buy Put: Strike Price at 90

- Desired Outcome: Stock stays above 95 at expiration

In both the call and put spread scenarios, collecting around 50% of the width of the strikes is the target. For instance, if the spreads are $5 wide, I’d look to collect around $2.50 in premiums. That’s the amount I aim to pocket — it’s about balancing the risk with the potential reward.

Want To Learn More About How To Trade Options?

Grab a free copy of our Ultimate Options Trading For Beginners course by clicking here

When to Sell an Iron Condor

Identifying Range-Bound Markets

When I’m looking for the right conditions to sell an iron condor, my primary indicator is a stock that is range-bound. A range-bound market is one where the stock trades within a set range. This is crucial because, in an iron condor, I’m selling both a call spread and a put spread, hoping neither side will be breached as the stock’s price remains within a specified range.

For example, if a stock trades between its 50-day moving average at, say, $140, and its 200-day moving average at $90, it’s a clear sign that it might remain sandwiched in this zone for some time. This situation is prime for an iron condor because the stock is not trending strongly in either direction.

| Signs of a Range-Bound Market |

|---|

| Top of Range |

| – 50-day moving average |

| – Price Level: $140 |

| Bottom of Range |

| – 200-day moving average |

| – Price Level: $90 |

Remember, my goal is to find that sweet spot where the stock trades almost equidistant from the top and bottom of the range, indicating limited movement.

Taking Advantage of High Implied Volatility

Another key element I consider is the level of implied volatility (IV) in the options market. High IV is typically associated with more expensive premium levels due to the increased extrinsic value of options. I want to sell an iron condor when these premiums are at their peak, giving me the opportunity to collect more credit upfront.

When IV is high, and therefore premiums are rich, that’s the scenario I’m after. It’s like selling lemonade on the hottest day; that’s when you’ll get the best price. So, if I see the option implied volatility is through the roof, that’s my cue to set up an iron condor.

Let’s break it down in simple terms:

- High IV means higher option prices.

- We sell high to collect more credit.

- Our goal is to enter during peak premium time.

By combining technical analysis with a keen eye on the implied volatility, I can strategically choose when to sell my iron condors for potentially larger profits. For instance, if I’m analyzing a stock that is priced around $115 — squarely in the middle of my identified range — and there’s high IV, I might seek a put spread with a lower strike around $90 and a call spread with a higher strike near $140. The key is always to pair these decisions with appropriate risk management and a profound understanding of market conditions.

Analyzing Market Conditions for Iron Condors

When I approach iron condors, I’m essentially playing with a call spread and a put spread at the same time. Here’s the trick: I always sell iron condors. This involves selling both a call spread on the upper side and a put spread on the lower side. Why? Because ideally, I’m looking for a stock that stays within a certain range – this is what I mean by range-bound.

For example, if a stock is wedged between its 50-day and 200-day moving averages, and it’s sitting pretty much in the middle of that range, that’s an ideal candidate for my iron condor setup.

Now, let’s break this down in terms of market conditions:

- Range-bound Market: This is my first green light. If a stock is not showing signs of breaking out of its current range, it’s safe territory for selling an iron condor.

- Implied Volatility: My second signal is high implied volatility. I hunt for times when option premiums are juicy – this means they are expensive, and it’s a sweeter deal to be the seller.

Let’s talk numbers. Take a stock trading between a 50-day MA at 140 and a 200-day MA at 90, just cruising along in the middle. That’s my playground.

- Expiration Choice: Short-term is my mantra – I prefer setting up these trades with no more than two weeks to expiration. I’m looking to avoid long-shot risks of the stock breaking out of its comfort zone.

- Strike Selection: For selling spreads, I leverage technical analysis to choose my strikes wisely. I look at the expected move to decide which strikes would be ideal for selling a put spread below and a call spread above the current trading range.

My pricing strategy in an iron condor is about balance. Ideally, I aim to collect about 50% of the width of the strikes on both sides. For instance, if I’m dealing with $5 wide put and call spreads, I’m not keen to sell for anything less than $2.50. This ensures a sensible risk-reward ratio.

In summary, I want to sell when I can capture maximum premium in a calculated, range-bound market with an expiration that aligns with my predictions. Remember, the ultimate goal is to keep the stock within the strike prices of both spreads until expiration or until I decide to close out the trade.

Time Frame for Selling Iron Condors

When I’m looking to sell an iron condor, timing is critical. Basically, I’m hoping the stock stays within a certain price range, so I need to choose my timing based on a few factors:

- Range-Bound Market: The primary condition for selling an iron condor is a stock I expect to trade within a certain range. If a stock is nestled between its 50-day and 200-day moving averages, like the example of a firm I cited, that’s usually a sweet spot for setting up my trade.

- Volatility: Another key element is volatility. I want to sell when option implied volatility (IV) is high—because that’s when options are most expensive. Selling expensive options means I can collect more premium upfront.

The decision of how long the iron condor should be in place also depends on:

- Expiration: Generally, I prefer not to go out more than two weeks for my iron condors. The reason is simple: the further out in time, the more chance the stock has to move out of the range. I lean towards using technical analysis, like expected moves, to choose strikes that align with my analysis and time frame.

Let me break down my ideal conditions using bullet points:

- Look for a stock positioned between significant moving averages (like the 50-day and 200-day).

- Ensure that implied volatility is high, implying pricier options to sell.

- Choose expirations no more than two weeks out to minimize risk.

When I’m setting up the trade:

- Strikes and Premiums: For a balanced iron condor, I’m combining a call spread and a put spread—ideally, I aim to collect about 50% of the width of the strikes on both sides.

- Maximum Exposure: Remember, the maximum value of an iron condor is the width between the strikes on one side of the trade, not the combined total. If I’m setting up a $5 wide spread on both sides, I can’t accrue more than $5 in value.

In practice, let’s say I’m interested in a stock trading in the middle between its 50-day moving average at $140 and its 200-day at $90:

- I look to sell a put spread around $90 and a call spread around $140.

- If these spreads are $5 wide each, I want to collect around $2.50 in premium.

I base my decisions on current technicals and the expected move to select strike prices—a proactive approach helps me optimize the time frame for selling an iron condor.

Choosing Strikes and Expected Move

When I’m setting up my iron condor trades, the selection of strikes and the expected move are crucial. I always aim to sell the iron condor, which involves selling a call spread and a put spread. The core idea is to profit when the stock stays within a specific range, what we call range-bound trading. My strategy shines when the stock remains sandwiched between its moving averages, unable to break out.

The critical factors I look for are:

- Range-bound stock: A stock trading between two key levels, like the 50-day and the 200-day moving averages, presents a prime opportunity. For instance, if a stock oscillates around $140 on the upper side and $90 on the lower side, this sets clear boundaries for my strike selection.

- High implied volatility (IV): I prefer to sell when the options are expensive, which is usually when IV is high. This is because options with elevated IV have pricier premiums, providing a potentially better sell situation.

To determine the ideal strikes, I use technical analysis and consider the expected move. Here’s a concrete example based on a stock trading between $90 and $140:

- Call Spread: Selling a call above the current price, with a strike near the upper range, such as $140.

- Put Spread: Selling a put below the current price, with a strike near the lower range, such as $90.

Now, let’s talk about the timing:

- Expiration Selection: I prefer to keep the expiration within two weeks. This timeframe reduces the risk of the stock breaking out of the range while still offering a decent credit from the premiums.

Regarding the price I look to collect on selling an iron condor, I aim for about 50% of the width of the strikes. So, if I’m dealing with $5 wide spreads on each side, I’m not looking to sell for anything less than $2.50 in total credit.

Lastly, remember that the maximum risk on an iron condor is the width of the wider spread minus the credit received. So, with $5 wide spreads, the max risk is capped at that $5 width per spread, not the cumulative $10 from both spreads.

Profit Goals and Risk Management

When I’m setting up an iron condor in the options market, my primary aim is to capitalize on a stock’s lack of movement, which is to say, I’m banking on it being range-bound. The reason? I’m selling both a call spread and a put spread, which benefits from the stock staying within a certain trading range – not too high, not too low.

Key Considerations for Iron Condor Setup:

- Ideal when expecting a stock to trade within a range

- Preferable when options have higher implied volatility (more expensive premiums)

For instance, say I’m eyeing a stock sandwiched between its 50-day and 200-day moving averages, seeming to settle comfortably in the middle. This is a visual cue that might suggest a good setup for an iron condor. In such a scenario, I’ve noticed two critical price points:

- Upper Limit: The 50-day moving average (example: 140)

- Lower Limit: The 200-day moving average (example: 90)

By establishing short positions through selling a put spread that bottoms around 90 and a call spread capped around 140, my goal is to see the stock linger in the middle.

Preference for Expiration Time:

- Short-dated; generally not more than two weeks to expiration

Why so short? The longer the duration, the more time there is for the stock to move outside that sweet spot; the more premium you might collect upfront, but the greater the risk.

When it comes to managing the potential profit and mitigating risks, I adhere to a rule of thumb:

- Aim to collect about 50% of the width of the strikes

Example: If I’m dealing with a $5 wide put spread and a $5 wide call spread on either side, my target would be to collect around $2.50 in premium – half the width of the strikes.

Understanding Maximum Risk:

- The max loss on an iron condor is the width of either the call spread or put spread (not combined), which for me, in the example provided, is $5.

It’s a strategic game of balance, not just between the expected range of the stock and the premium collected, but also between profit aspirations and the acceptance of risk. My preference is to play it smart with timing, premiums, and by using technical analysis, such as expected moves, to choose ideal strike prices. Even with decades of experience, respecting the boundaries of risk management has proven crucial every time I layout an iron condor strategy.

Determining the Maximum Value of an Iron Condor

When I’m trading iron condors, one critical factor is determining the maximum value of the position. I always aim to collect a premium that is approximately 50% of the width of the strikes. It’s pretty straightforward: an iron condor is a combination of a put spread and a call spread, which I typically sell to capitalize on a stock’s range-bound movement and high option implied volatility.

To give you a clear example from a recent trade analysis of a stock (we’ll call it AFRM for reference), it was trading between its 50-day moving average (about 140) and 200-day moving average (around 90), staying right in the middle—a perfect scenario for a profitable iron condor.

Here’s a breakdown of the trade setup:

- Bull Put Spread: Sell the AFRM 95 Put and buy the AFRM 90 Put.

- Bear Call Spread: Sell the AFRM 135 Call and buy the AFRM 140 Call.

For both spreads, the strike difference is $5, making the maximum risk on either side $5. However, because these two credit spreads are on opposite sides, the iron condor’s maximum risk is not the combined value but the risk on a single side.

This simple table outlines the ideal scenario:

| Strike Prices | Position | Width | Ideal Premium |

|---|---|---|---|

| 95/90 | Bull Put Spread | $5 | $2.50 |

| 135/140 | Bear Call Spread | $5 | $2.50 |

When I checked the prices for the AFRM example, they were trading at about $1.20, which is less than the target 50% premium of the strike width. Hence, it wasn’t attractive enough for my trade entry criteria.

Remember, the max value that an iron condor can reach is the spread width, which, in this case, is $5. Even if the stock breaks out and goes through either my call or put spread strikes, the maximum it can be worth is the width of one side of the trade, not the total width of both sides combined. This principle is pivotal for risk management and profit expectations when setting up iron condors.

Final Considerations Before Selling

When I consider selling an iron condor, there are a few key things I always keep in mind. Here’s what I focus on:

Timing: Timing is crucial. I look for periods when implied volatility is high—the premiums are then more expensive, and it’s more beneficial to sell. I aim to sell when I predict that the stock will remain range-bound between significant technical levels, like moving averages.

Stock Range: Before I put on an iron condor, I make sure the stock is trading within a range that I believe will hold. For instance, if a stock is positioned between its 50-day and 200-day moving averages, that can indicate a stable range.

Strike Selection and Width: Choosing the right strikes for both the call and put spreads is important. I prefer a distance that allows me to collect about 50% of the width of the strikes. This means if I am dealing with $5 wide spreads, I’m looking to collect around $2.50 in premium.

Trade Duration: The length of time until expiration affects the risk. I typically opt for two weeks or less because the longer the duration, the more time there is for the stock to move out of the desired range.

Price: The combined premium of the put and call spread should meet my target. With a $5 wide spread on either side, I wouldn’t want to sell for only $1.20; it doesn’t meet my criteria to collect roughly half the width of the strikes.

Risk Management: Understanding the max loss, which is the width between the strikes of one side of the trade, is vital. I need to be comfortable with this risk if the market moves against my position.

Remember, the ultimate goal is for both options to expire worthless, allowing me to keep the full premium collected. However, always being prepared to adjust or close the trade ahead of expiration if things aren’t looking favourable is part of the strategy.

Want To Learn More About How To Trade Options?

Grab a free copy of our Ultimate Options Trading For Beginners course by clicking here