In the dynamic realm of financial markets, Artificial Intelligence (AI) has become a vital asset for traders seeking a competitive advantage. AI trading tools utilize intricate algorithms, machine learning, and extensive data to offer insights, automate trading, and identify real-time trends that elude human detection.

Finding High Profit Potential Trades

One of the biggest impacts AI trading software is having are the ways it can find high profit potential trades. One AI trading tool – called the A.I. Trade Finder – is designed to specifically focus on this aspect. It uses aggregated historical data from thousands of stocks to identify the market’s highest-profit potential trade ideas. The program is run by Charlie Moon, a pro trader with over 20 years experience, who’s been featured on networks like Fox Business, TD Ameritrade, and BNN Bloomberg.

Charlie released a free A.I. trading guide that explains in depth how this technology can find you dozens of high profit potential trade ideas every day. Click here to check out.

Key Takeaways

- AI trading tools automate trades, offering insights and real-time trend identification

- One of the biggest determinants for finding the right AI trading tool is how it aligns with your specific trading needs and goals

- The most important factors to consider in an AI trading platform’s navigability, timeliness, and what data it uses to identify high profit potential trades

How The A.I. Trade Finder Works

The A.I. Trade Finder is programmed to scan the market every morning for high profit potential trade ideas. It finds these trade opportunities using hundreds of technical indicators and tools like the RSI, support and resistance, bullish or bearish chart formations, etc. The A.I. Trade Finder basically has individual trackers for several different kinds of setups: Buy the Dip, Bullish Burst, MACD Momentum, along with pre or post-earnings plays – just to mention a few.

After each market scan, the A.I. Trade Finder highlights which stocks were triggered by certain trade setups that produced the highest historical win rates and cumulative gains. It tallies how many times a trade setup was triggered in an individual stock over a specified timeframe. The Trade Finder then analyzes how the stock performed after each of these instances, and uses this data to create a step-by-step blueprint that you can use for this existing trade opportunity.

It does this in 3 steps:

Step 1: Finding the right stocks to consider trading. It requires no complicated scanners or trading formulas with dozens of different steps to follow. You just select a few names the A.I. Trade Finder spits out every day.

Step 2: Let the A.I. Trade Finder calculate which strategy can make the highest profit potential trade in a stock. This part is pretty cut and dry – the AI will recommend if you should buy a call or put, and whether or not you should use trade setups like a vertical or diagonal spread, etc.

Step 3: Verify the stock and strategy on the charts. The A.I. Trade Finder uses historical data from the stock to break down the necessary sequence of events that triggered the trade setup in question. This usually requires the stock price being higher or lower than key indicators – like EMAs, SMAs, RSI, etc. – over a specific timeframe.

That’s basically how it works in a nutshell. To reiterate…when I say the A.I. Trade Finder does all the heavy lifting, as you can see, it literally narrows down your options – phasing out all the noise, and giving you a clear cut path for finding the right high profit potential trades to consider making.

The A.I. Trade Finder generates this data in about 60 seconds. It saves you countless hours of searching for the right stocks – allowing you to focus on what trades to consider making.

A.I. Trade Finder in Action

Let’s show you how the A.I. Trade Finder works in action. Here’s one example of a high profit potential trade it identified. Note: these are historical cumulative returns the AI calculated based on the strategy it recommended.

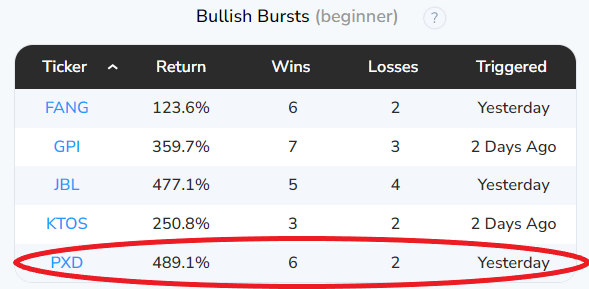

This first window reveals that a trade setup called the “Bullish Burst” was triggered in Pioneer Natural Resources (PXD) on January 24.

Onto the next window…

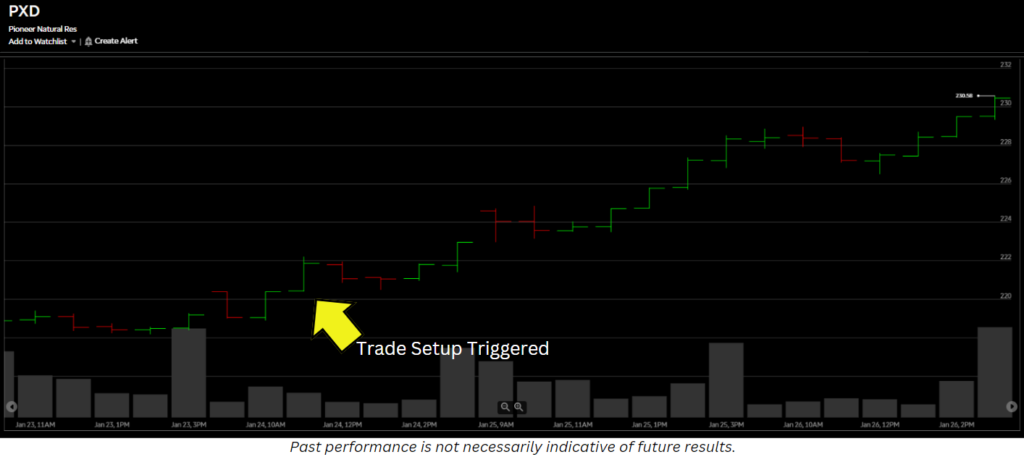

This one contains a lot of information, so we’ll break it down into bite-sized pieces…

The A.I. Trade Finder revealed this setup was triggered in PXD eight times since 2020. The red and green arrows show when the “Bullish Burst” setup was triggered, and how PXD performed after each of those instances over this three-year timeframe…

That gray bar you see (above the chart) contains the most important information. It explains what criteria is required to trigger the “Bullish Burst” setup in PXD. In this scenario, it basically says the following:

- The stock price needs to be above the EMA over the last 10 days

- The previous day’s stock price needs to be below the previous day’s 10-day EMA

- The stock price needs to be above the 200-day SMA

- The 50-day SMA has to be greater than the underlying stock price

- The 20-day RSI needs to be below 70

So, to recap, here’s what the A.I. Trade Finder is recommending:

- Look at the stock PXD

- Buy Delta Calls

- Buy Delta calls at a specific strike price that expire in 14 days with a 60% stop and 40% limit

Here’s how PXD wound up moving after the “Bullish Burst” setup was triggered in it on January 24…

If you want to see more examples of high profit potential trades the A.I. Trade Finder identified – click here to check out Charlie’s free AI trading guide.

Conclusion

When using AI trading tools to find high profit potential trades, it’s important to carefully consider your options, and determine how each one aligns with your unique trading goals. Every AI software uses different tools, indicators, and data for finding high profit potential trades.

- Navigability: AI trading tools should be cohesive and straightforward to use, allowing you to utilize its features in a user-friendly manner.

- Timeliness: Timing is everything when finding potential high profit trades. It’s critical to find an AI trading software that caters to this aspect.

- Consolidation: When searching for high profit potential trades, it’s essential to find a unified platform that provides efficient decision-making by streamlining and centralizing data.

While AI trading tools provide valuable features like real-time trends and automation, it’s crucial to acknowledge their limitations. Approach choices with diligence, balancing potential benefits like informed decisions and time-saving. We advise thorough research and platform testing before committing, ensuring traders harness the unique advantages AI offers.