Options trading is filled with obstacles that can derail one’s ability to potentially succeed in this space. Some of these issues require the help of outside resources to resolve. In these cases, tools like Artificial Intelligence can play a pivotal role in helping options traders smash these barriers, and overcome these stifling problems.

What Can Artificial Intelligence Tell Us About Options Trading Issues?

Artificial Intelligence is revealing some of the most crippling options trading issues. One pro trader named Charlie Moon said some of these problems became clear to him after he started using a machine learning tool called the A.I. Trade Finder (more on that shortly).

Charlie believes these issues stem from a lack of adequate ways to organize and understand the different variables and technical aspects in options trading. This includes searching for the right stocks, options trading strategies, and recognizing or interpreting technical details.

Machine learning tools – like Charlie’s A.I. Trade Finder – scan thousands of stocks for potential high-profit trade opportunities. It uses historical data to highlight which ones offer the highest win rates and cumulative returns. This device even maps out how to potentially make each trade. It does all the searching and analysis in about 60 seconds, saving options traders countless hours of research.

Charlie published a free A.I. trading guide with more details on how A.I. tools can solve some of the biggest options trading issues. Click here to check it out.

Main Takeaways

- A.I. trading tools are playing a key role in solving some of the biggest options trading issues

- Some of the biggest problems options traders face are searching for stocks, trading strategies, and interpreting technical details

- A.I. tools are helping options traders overcome these issues by doing all the research and technical analysis in seconds

Three Main Options Trading Issues

While they vary on a case-by-case basis, options traders could face a number of different issues. Charlie Moon believes the A.I. Trade Finder helped him identify three of the common ones in options trading.

Searching For Stocks

Traders waste too much time looking for the right stocks. In many cases, they don’t even realize how many hours they spend searching…or how it detrimentally affects their options trading. To that point, Charlie says the Trade Finder helped him notice something particularly ironic about this trend – while traders get sidetracked searching, they wind up missing tons of potential high-profit options trading opportunities.

Finding The Right Options Trading Strategies

The next major roadblock is picking an options trading strategy. Some critical details include what direction a stock is expected to move, the technicals for each method, and current market conditions. For many traders – especially beginners – weighing all these metrics at once can be overwhelming. Even with the right stocks, it’s not uncommon for traders to use the wrong strategies, or apply them incorrectly.

Interpreting Technical Chart Details

Recognizing and analyzing technical data on a stock’s chart can significantly increase your chances of making potential winning trades. While understanding these metrics is important, many everyday traders don’t have the time or mental capacity to properly learn how they work. As a result, it causes many to miss tons of potential high-profit trade opportunities, or make potentially avoidable losing ones.

How The A.I. Trade Finder Helps Solve These Issues

In a nutshell, A.I. tools, like the Trade Finder, are specifically designed to minimize or eliminate how much time you spend searching. While these tasks may take hours for your average options trader, the A.I. Trade Finder completes them in about 60 seconds. These capabilities can potentially help traders avoid getting sidetracked or overwhelmed by these aforementioned issues.

Finding The Right Stocks

The Trade finder scans thousands of stocks for the highest-profit potential options trading opportunities. The A.I. looks for certain setups triggered in a stock that signal it’s positioned for a huge potential move. It then uses historical data to highlight which ones generated the highest win rates and cumulative returns. It would be impossible to physically do all this on your own in one day. The A.I. Trade Finder, however, generates this data in about 60 seconds.

Check out this example…

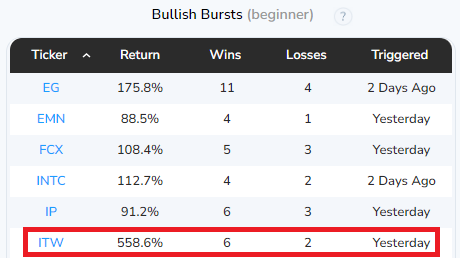

The Trade Finder helped Charlie spot this trade opportunity in Illinois Tool Works (ITW)…

The A.I. reveals it spotted a trade setup called the “Bullish Burst” in ITW. Over the last eight times this setup was triggered in ITW, it produced six winning trades – a 75%* win rate – and over 558%* cumulative returns. That means if you traded ITW the last eight times this setup was triggered in it, you could have potentially netted a total return of 558.6%.

Determining The Best Options Trading Strategies

After highlighting the highest-profit potential options trading opportunities, the Trade Finder reveals which options trading strategy to consider using. It even lays out how to potentially make the trade. This helps options traders potentially avoid wasting time weighing different strategies, and determining how factors like market conditions could potentially affect the trade’s outcome.

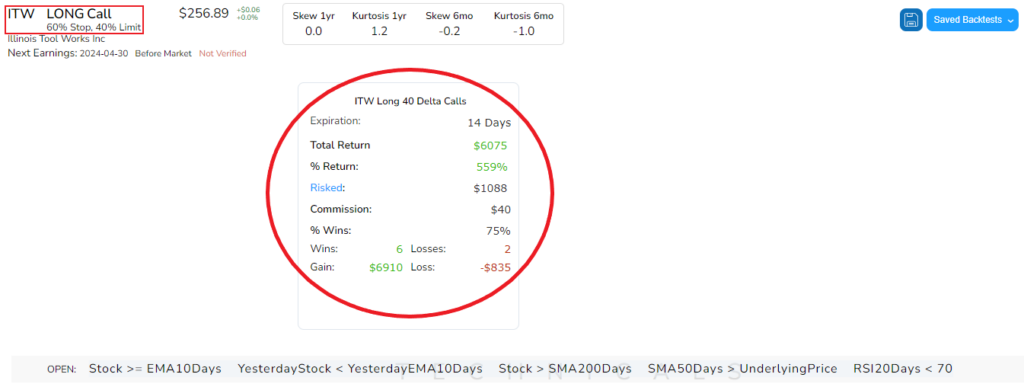

Let’s revisit our example in ITW to show what we mean…

This section explains which strategy to consider using in the trade. In our example, the Trade Finder suggests Long Delta Calls. It recommends the types of orders (stop, limit) to potentially trade, how many contracts (40), and when they should expire (14 days). The Trade Finder even calculates how much you could have potentially made all eight times this setup was previously triggered in ITW.

Verifying Technical Chart Details

The A.I. Trade Finder identifies high-profit potential options trading opportunities, using hundreds of technical indicators to spot certain setups triggered in stocks. Each triggered trade setup must satisfy a specific set of technical requirements. They usually involve the stock price to stay above or below certain indicators over a fixed timeframe. Fully understanding all these metrics is beyond most options traders’ capabilities – especially beginners. The A.I. Trade Finder puts this data on display – allowing traders to verify each technical requirement was satisfied.

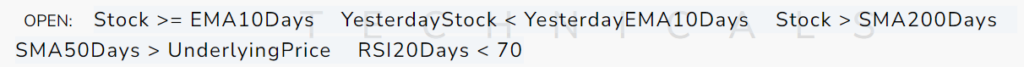

Here’s what the “Bullish Burst” trade setup requirements look like in our ITW example…

Everything you need to know is displayed in the light gray bar. We’ll elaborate on what each technical requirement means:

- The stock price needs to be above the Exponential Moving Average (EMA) for the last 10 days

- The previous day’s 10-day EMA has to be above the previous day’s stock price

- The stock price must be above the 200-day Simple Moving Average (SMA)

- The 50-day SMA has to be higher than the stock’s underlying price

- The 20-day Relative Strength Index (RSI) needs to be below 70

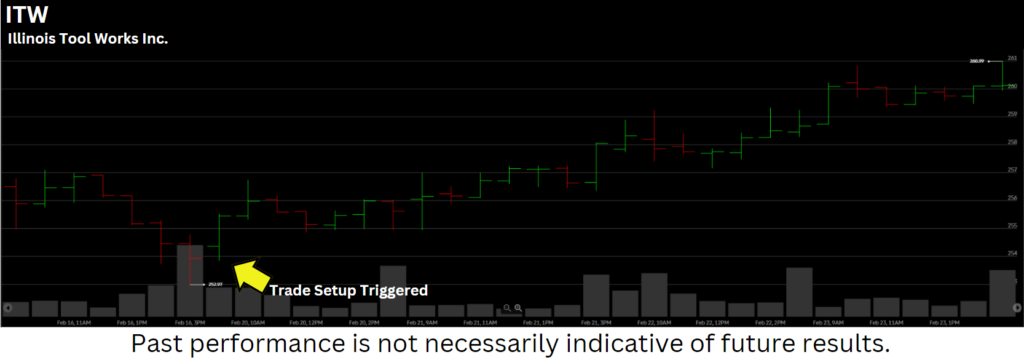

So, we explained how A.I. tools can potentially help solve three of the biggest options trading issues. Let’s see what happened in ITW after the Trade Finder spotted this triggered setup…

The yellow arrow shows when the setup was triggered in ITW. The A.I. recommended using an options trading strategy that banks on ITW going up…and its calculation was on point. If left to their own devices, a lot of traders would probably miss this play or trade it the wrong way, due to those three glaring issues we just covered. The Trade Finder, however, generated every piece of essential information with detailed accuracy to help make an informed trading decision.

You can find out more about how Artificial Intelligence is helping solve some of the biggest issues options traders face in Charlie Moon’s free A.I. trading guide.

Conclusion

Artificial Intelligence is helping traders of all experience levels get a firmer grasp on how to potentially minimize – or outright avoid – some of the most troubling options trading issues. Its ability to dynamically generate technical data in a graspable manner helps traders save time searching and contemplating, so they can focus on making actual options trades.

- Streamlining: A.I. trading tools are designed to complete tedious, lengthy tasks at dynamic speeds that would otherwise take hours – or days – to do on our own.

- Reallocation: Options traders can rely on A.I. technology to generate pertinent technical data in a more detailed and accurate manner.

- Clarification: A.I. trading tools can solve some of the biggest options trading issues by presenting technical data in bite-sized pieces.

Before using A.I. technology to potentially help overcome your biggest options trading issues, you should first determine which ones give you the most trouble. After isolating these factors, find an A.I. platform that’s capable of solving them by performing, or assisting you with functions that pertain to your trading issues. Always remember there are no guarantees in options trading, and to go with A.I. tools whose functions most closely align with your unique trading goals.